NEW

Other

Altman Z-Score Financial Model

$19.99

Our customizable Altman Z-Score Financial Model Template calculates the Altman Z-Score and its key components, providing a detailed assessment of your company’s financial stability. Ideal for risk assessment, strategic planning, and investment evaluation, this template features clear, professional formatting, enabling you to confidently present your company’s financial health and risk profile to investors or stakeholders.

Description

Find additional templates here.

Key Features

-

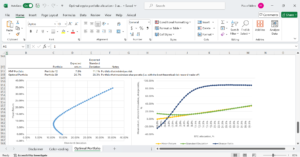

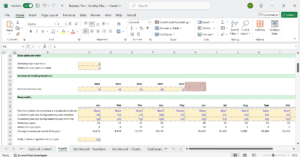

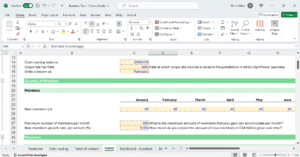

- Altman Z-Score Calculation: Automatically calculate the Altman Z-Score using key financial metrics such as working capital, retained earnings, EBIT, and total assets. This score provides a clear indication of your company’s financial health and risk of insolvency.

- Component Ratio Analysis: Break down the Z-Score into its five component ratios to understand the specific areas that impact your company’s score:

-

- Working Capital to Total Assets: </strong>Measures liquidity and operational efficiency.

- Retained Earnings to Total Assets: Evaluates cumulative profitability and the ability to reinvest earnings.

- <strong>EBIT to Total Assets: Assesses operational efficiency and profitability.

- Market Value of Equity to Total Liabilities: Determines financial leverage and market perception of risk.

-

- Sales to Total Assets: Analyzes asset utilization and operational efficiency. <li

- flect your specific business circumstances, ensuring accurate and relevant risk assessments.

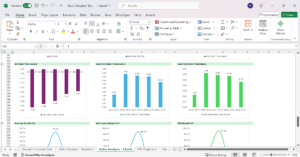

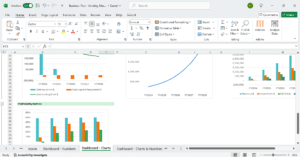

- Professional Reporting: Generate comprehensive reports that present your company’s financial risk in a clear and concise manner. These reports are designed to be easily understood by investors, stakeholders, or board members, providing them with critical insights into your company’s financial stability.

Benefits

- User-Friendly: Designed with clear instructions and built-in formulas to make financial modelling both efficient and straightforward.

- Professional Reporting: Produce polished financial reports to impress investors, lenders, and business partners.

Who is this template for?

- Business Owners and Managers: Gain a deep understanding of your company’s financial stability and identify potential risks before they become critical issues. This template is essential for strategic planning and risk management.

- Investors and Acquirers: Evaluate the financial stability of potential investments by assessing the risk of bankruptcy using the Altman Z-Score. This tool helps you make informed decisions and manage investment risk.

- Consultants and Advisors: Provide your clients with expert financial risk assessments and insightful reports. This template is a valuable asset for delivering high-quality advisory services and helping clients mitigate financial risk.

So much More

What’s Included?

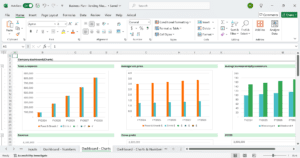

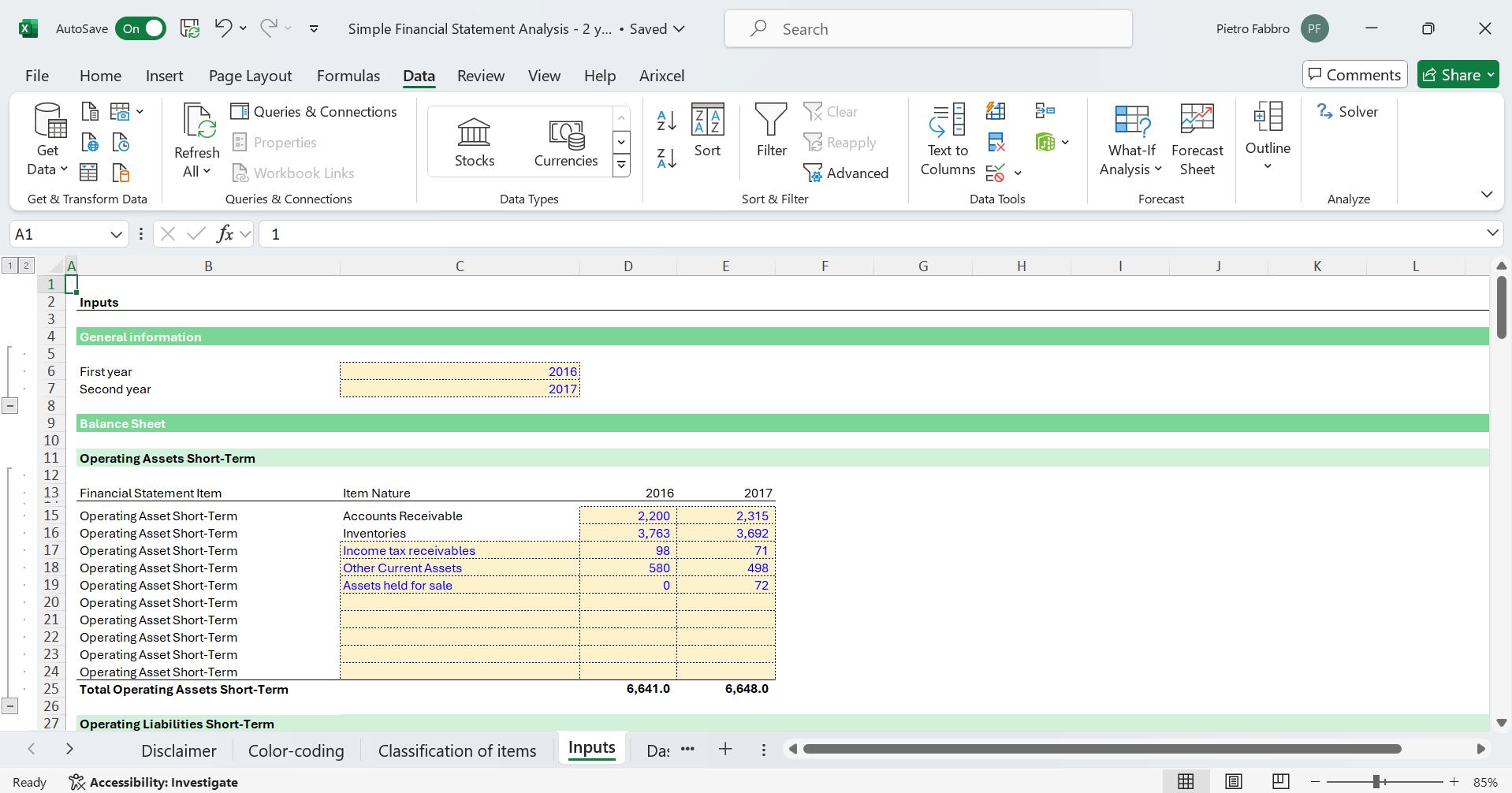

Pro-forma Financial Statements

Historical Fundamental Data

Free email-support

Financial Ratio Analysis

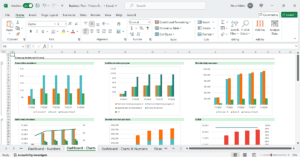

Charts and dashboards

Business Valuation

5-Year Revenue and Costs Projection

Watch the Tutorial

Related Products

Reviewed by experts from leading organizations