Financial Models

Creating a Comprehensive 3-Statement Financial Model Template

A three-statement financial model in Excel is a fundamental tool for businesses to forecast their financial performance, evaluate strategic decisions, and communicate their financial health to stakeholders. This guide will walk you through the essentials of a three-statement financial model and how to effectively create and utilize an Excel template for your business needs.

Understanding the 3-Statement Financial Model

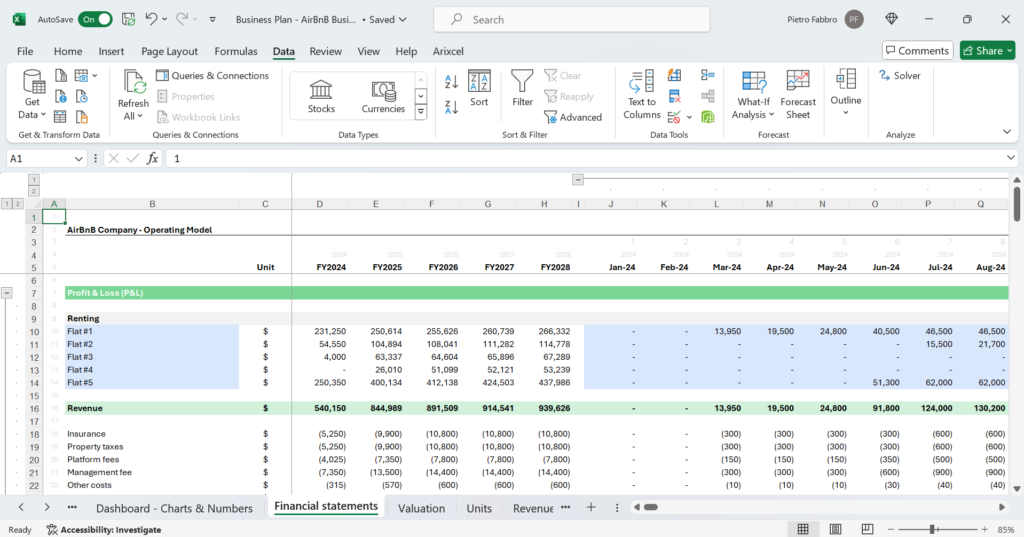

The three-statement financial model consists of three key financial statements:

- Income Statement: Shows the revenues, expenses, and profits (or losses) over a specific period.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Tracks the cash inflows and outflows from operating, investing, and financing activities.

Why Use a 3-Statement Financial Model?

A three-statement financial model is essential for:

- Financial Forecasting: Predicting future financial performance based on historical data and assumptions.

- Decision-Making: Evaluating the financial impact of strategic decisions, such as investments, expansions, or operational changes.

- Investor Communication: Presenting a clear and comprehensive overview of the company’s financial position to investors and stakeholders.

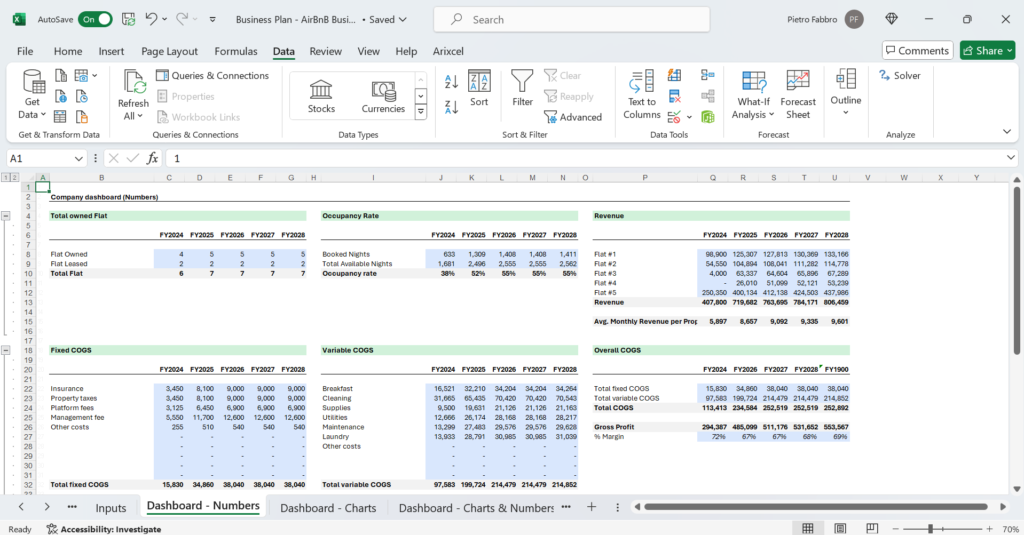

Components of a 3-Statement Financial Model Excel Template

1. Income Statement

The income statement template includes:

- Revenue projections

- Cost of goods sold (COGS)

- Operating expenses

- Depreciation and amortization

- Interest and taxes

2. Balance Sheet

The balance sheet template features:

- Assets (current and non-current)

- Liabilities (current and non-current)

- Shareholders’ equity

- Supporting schedules (e.g., depreciation, debt amortization)

3. Cash Flow Statement

The cash flow statement template covers:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities

- Net change in cash and cash equivalents

Building a 3-Statement Financial Model Excel Template

1. Set Up Your Excel Workbook

Organize your workbook with separate sheets for each financial statement and supporting schedules. Use consistent formatting and labels to maintain clarity and ease of navigation.

2. Input Assumptions and Variables

Create an input sheet to enter key assumptions and variables that drive your financial projections. This may include revenue growth rates, expense percentages, and capital expenditure plans.

3. Develop Formulas and Link Statements

Use Excel formulas to link the income statement, balance sheet, and cash flow statement. Ensure that changes in one statement automatically update the others to maintain consistency and accuracy.

4. Include Sensitivity Analysis and Scenarios

Conduct sensitivity analysis by varying key assumptions to understand their impact on financial outcomes. Create scenarios to evaluate different business strategies or market conditions.

5. Validate and Test Your Model

Validate your financial model for accuracy by comparing projected results with historical data and industry benchmarks. Test the model using different scenarios to identify potential risks and opportunities.

Where to Find 3-Statement Financial Model Excel Templates

1. Sheets.Market

Explore a variety of professionally designed 3-statement financial model Excel templates at Sheets.Market. These templates are customizable and tailored to suit various industries and business needs.

2. Microsoft Office Templates

Microsoft Excel offers pre-built templates for income statements, balance sheets, and cash flow statements. These templates can be customized to create a comprehensive three-statement financial model for your business.

3. Online Financial Modeling Platforms

Platforms like efinancialmodels and Slidebean provide downloadable Excel templates for three-statement financial models. Browse their libraries to find templates that best fit your business requirements.

Tips for Using a 3-Statement Financial Model Excel Template Effectively

- Regular Updates: Update your financial model regularly with actual data to refine projections and ensure relevance.

- Document Assumptions: Clearly document all assumptions and methodologies used in the financial model for transparency and accountability.

- Training and Familiarity: Ensure that your team members are trained in using the financial model effectively to maximize its benefits for decision-making.

Conclusion

Building a comprehensive three-statement financial model Excel template is essential for businesses to plan, forecast, and make informed decisions. Whether you’re a startup seeking investment or an established company planning for growth, a well-designed financial model provides clarity and insights into your financial performance. Explore the available templates, customize them to your business needs, and start leveraging the power of financial modeling to drive success.

Ready to streamline your financial planning? Visit Sheets.Market to find customizable 3-statement financial model Excel templates tailored for your business. Start forecasting with confidence today!