The padel industry is gaining significant momentum, attracting a growing number of participants across various age groups. However, the challenge of achieving profitability lies in managing high startup costs and maintaining consistent operational efficiency. A well-structured Padel club business model focusing on asset allocation, diversified revenue streams, and strict cost control is vital for long-term

Archivio Categoria: Financial Models

Building, analyzing, and optimizing financial models for businesses and investments.

The carpet cleaning industry is characterized by fragmented competition, low entry barriers, and significant operational efficiency variability. While the U.S. market is projected to grow at a 3.4% CAGR through 2030, reaching 147,645.5 million, average EBITDA margins for independent operators hover at 10–15%, constrained by labor intensity, fuel volatility, and customer acquisition costs (CAC). Carpet

The escape room industry has experienced rapid growth in recent years as part of the broader entertainment and leisure sector. However, achieving sustained profitability requires navigating high startup costs, location-based challenges, and a highly competitive market. A structured escape room business model focusing on optimal asset configuration, strategic pricing, and cost control is essential for maximizing

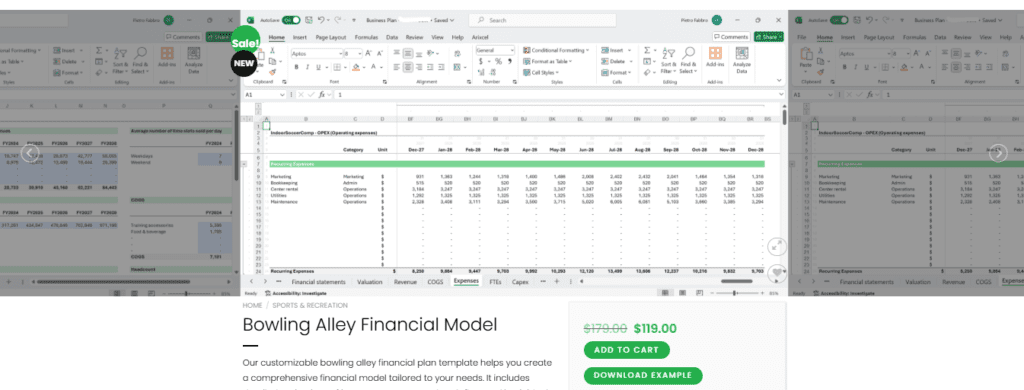

The bowling industry has faced profitability challenges over the past two decades, with a 2% annual decline in U.S. bowling centers from 2018-2023. Operators have adopted hybrid models combining recreation, dining, and entertainment to survive. Success relies on balancing high fixed costs with diversified revenue streams. This analysis offers benchmarks and strategies to achieve 15-20%

The CrossFit industry has grown rapidly due to its community-driven model and high-intensity training methodology. However, profitability is constrained by high instructor costs, fluctuating membership retention, and competition from conventional gyms. A structured business model is essential for sustaining margins and scaling operations. Asset Configuration CrossFit gyms require a lower upfront investment than traditional fitness

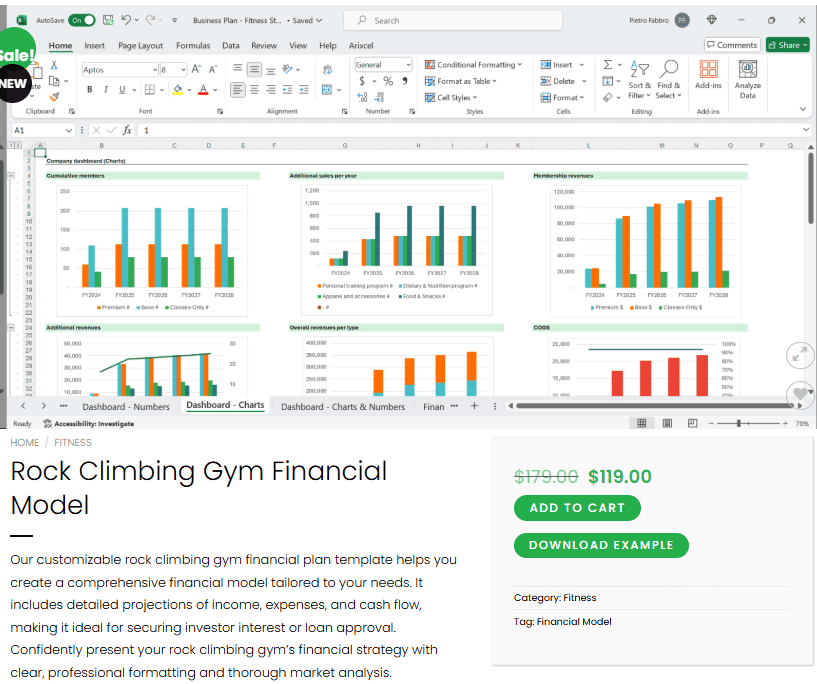

The indoor rock climbing industry is experiencing rapid growth, driven by increasing interest in adventure sports and fitness alternatives. However, profitability is constrained by high initial capital investments, specialized equipment costs, and operational complexities. A structured business model is essential for achieving sustainable margins. Asset Configuration Rock climbing gyms require significant upfront investment in facility

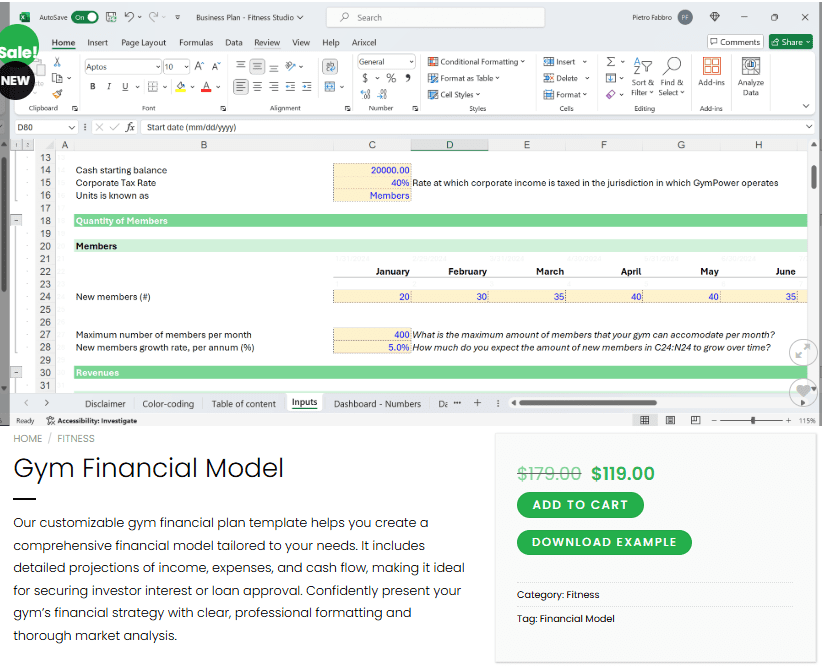

The fitness industry presents a high-revenue opportunity but remains operationally complex. While demand for gym memberships remains strong, profitability is often constrained by high fixed costs, member churn, and competitive pricing. A structured business model is essential to achieving sustainable margins. Asset Configuration Gym businesses require significant upfront investment in real estate, equipment, and interior

The ice cream industry offers attractive gross margins (60%–70%), but ice cream shop profitability depends on efficient cost management, strategic pricing, and revenue diversification. Seasonality, high rent, and operational costs challenge profitability, making a structured business model essential. Asset Configuration Investing in the right location and equipment is critical to ice cream shop profitability. Prime

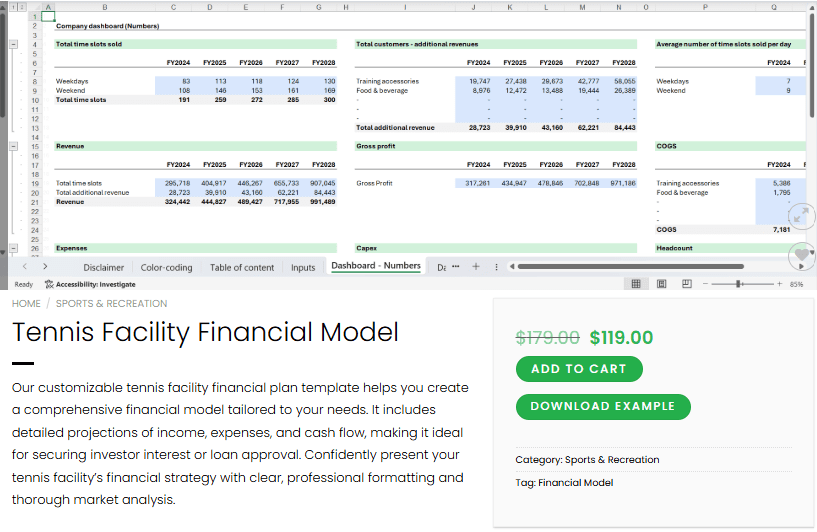

A tennis facility’s profitability hinges on strategic asset configuration, diversified revenue streams, and rigorous cost management. Without a structured approach, facilities face high fixed costs, seasonal demand fluctuations, and revenue constraints. A data-driven business model is critical to ensuring sustainable margins and long-term viability. Asset Configuration Capital expenditure (CapEx) is the foundation of a tennis

The cleaning industry presents a low-barrier entry point but operates in a highly competitive, price-sensitive environment. Profitability depends on asset configuration, service diversification, operational efficiency, and pricing discipline. Without a structured business model, margins erode quickly due to labor-intensive operations and fluctuating customer acquisition costs. Asset Configuration The initial capital expenditure (CapEx) varies based on