NOUVEAU

Autre

Modèle financier d'allocation optimale de portefeuille – 3 actifs

$19.99

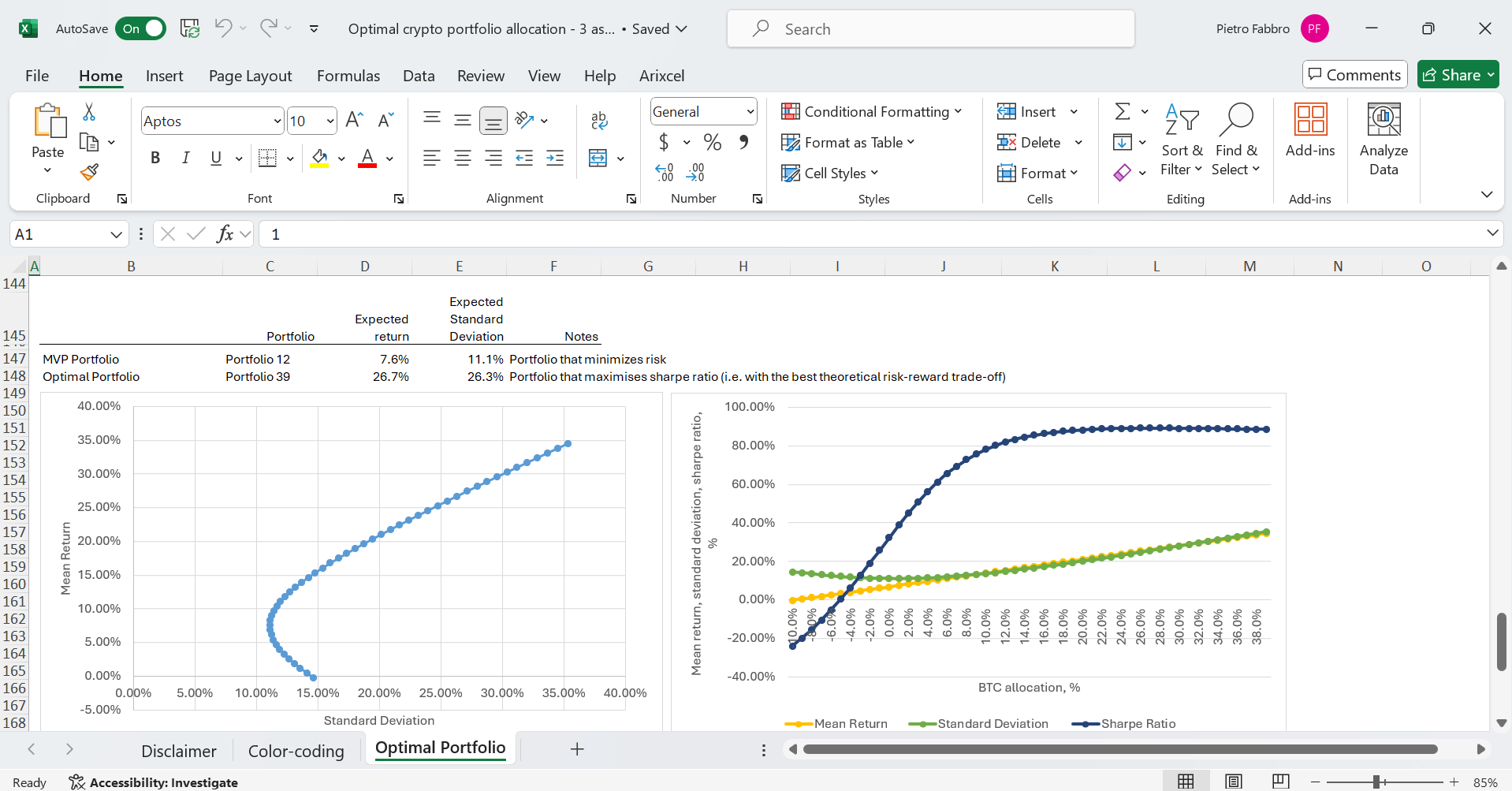

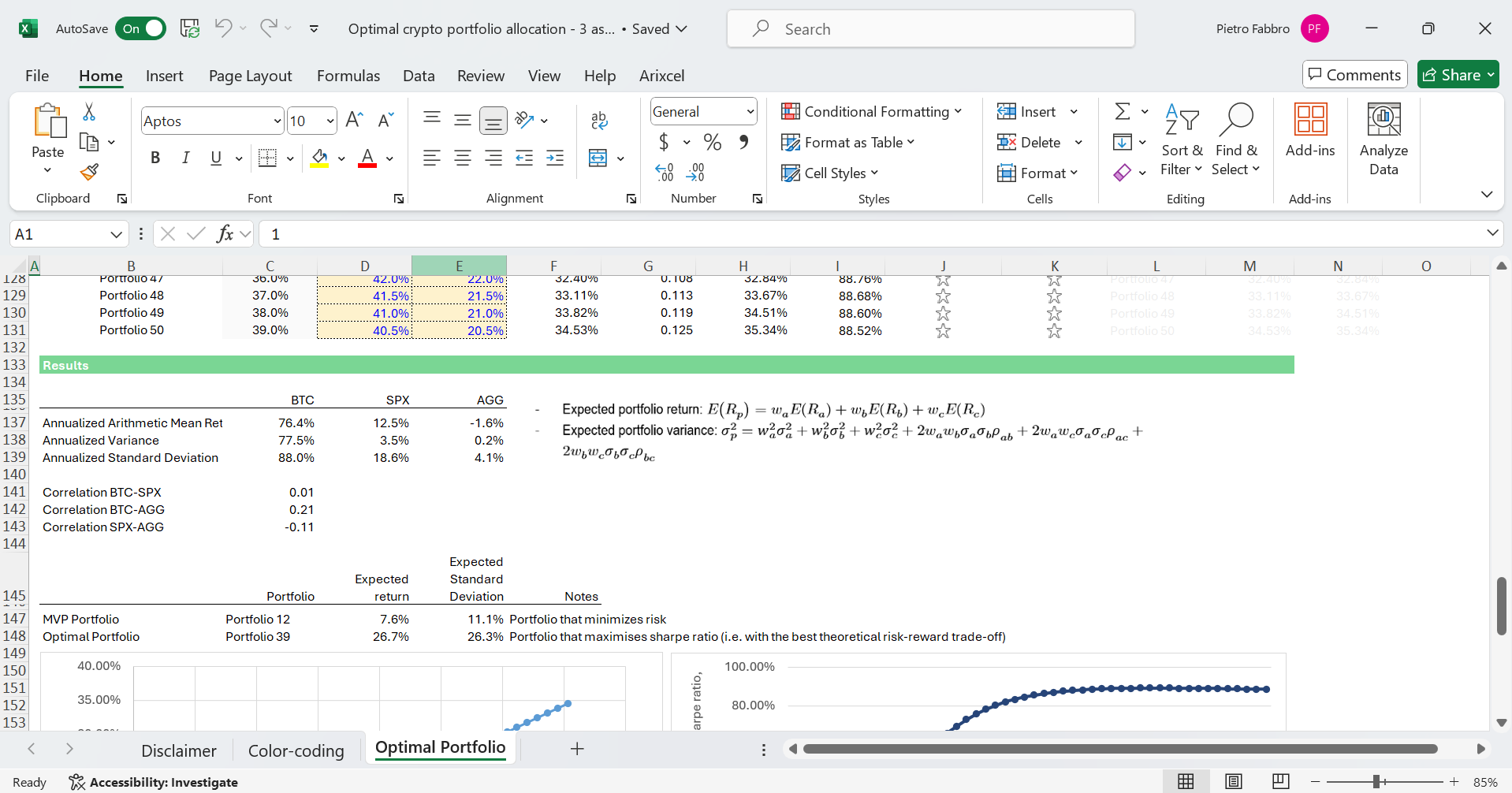

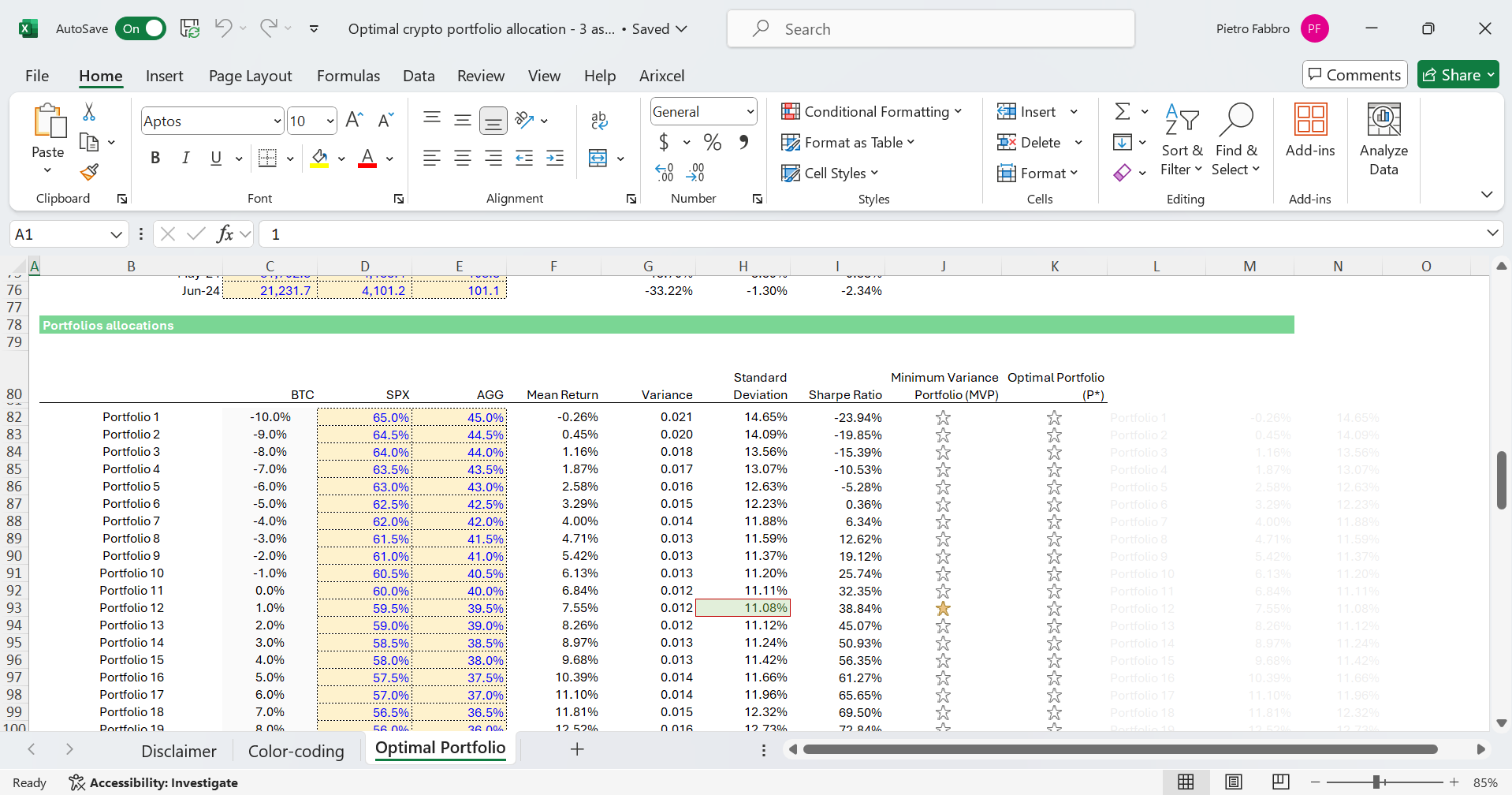

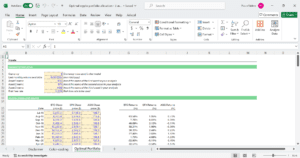

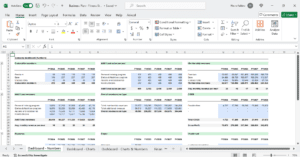

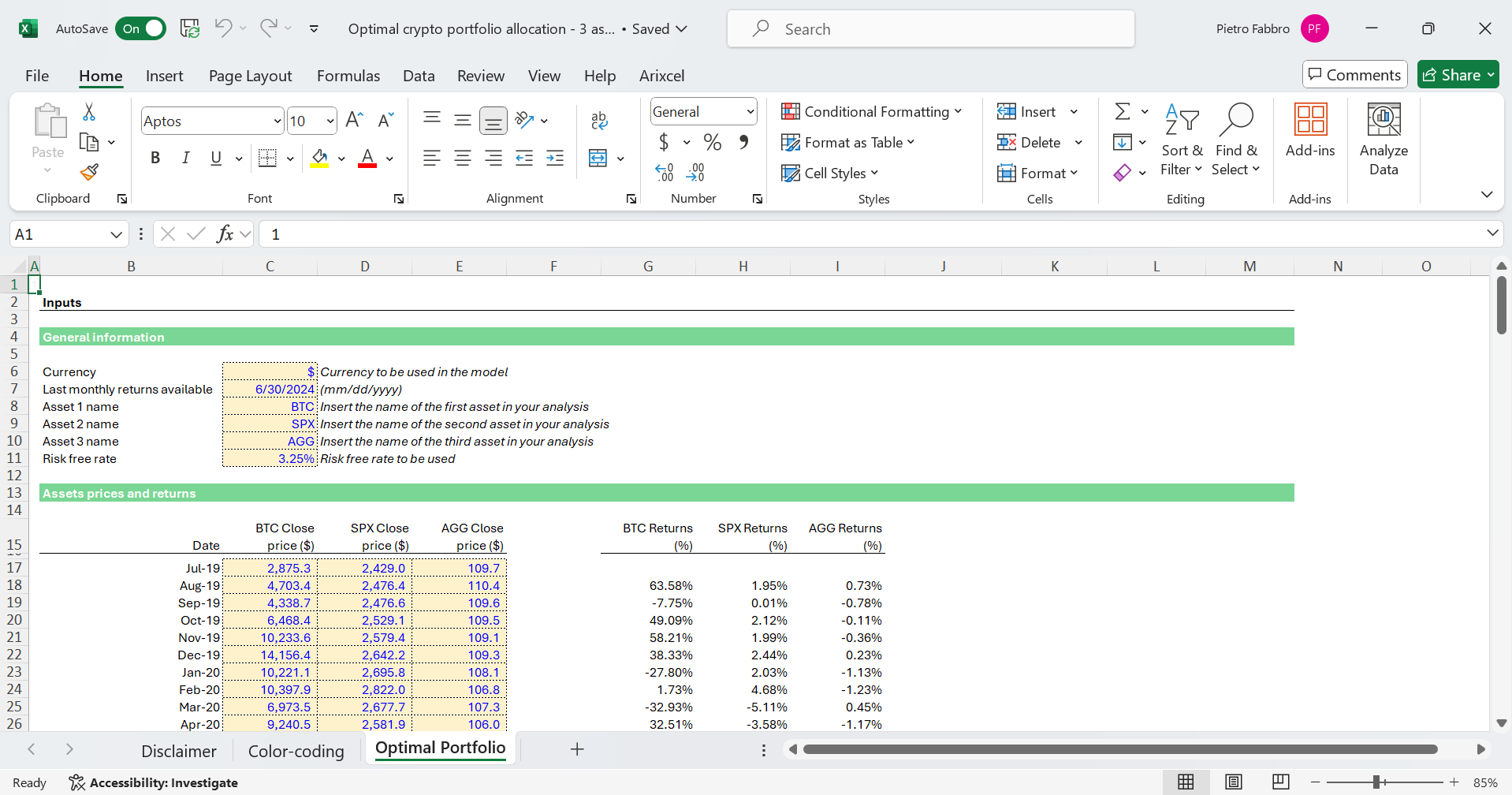

Our customizable Portfolio Allocation template calculates the optimal allocation among three assets by determining the Minimum Variance Portfolio (MVP) and the Optimal Portfolio (maximizing Sharpe ratios). Based on 60 months of price data, this template generates insightful charts and provides a detailed assessment of your portfolio’s risk-return profile. Ideal for strategic planning, investment evaluation, and reporting, this template features clear, professional formatting, enabling you to confidently present your optimized portfolio strategy to investors or stakeholders.

Description

Trouver des modèles supplémentaires ici.

Caractéristiques principales

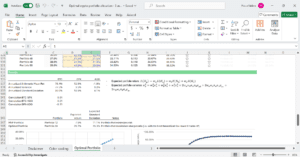

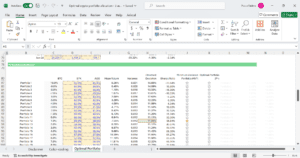

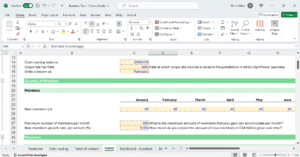

- Comprehensive Portfolio Analysis: Automatically calculate the optimal allocation of assets in your portfolio to achieve the lowest possible risk (MVP) and the highest risk-adjusted return (Optimal Portfolio). These calculations help you identify the most efficient investment strategy.

- Minimum Variance Portfolio (MVP): Determine the asset allocation that minimizes portfolio risk. This feature is essential for investors looking to maintain a low-risk profile while maximizing returns.

- Optimal Portfolio (Maximizing Sharpe Ratio): Calculate the portfolio allocation that maximizes the Sharpe ratio, providing the best risk-adjusted return. This feature is ideal for investors seeking to optimize their portfolio performance relative to risk.

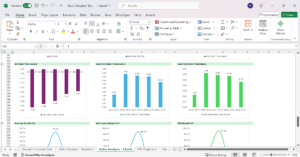

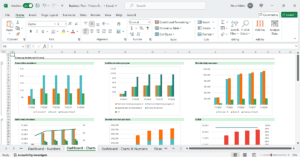

- Graphiques interactifs : Visualize your portfolio’s risk-return profile with customizable charts that clearly display the efficient frontier. These charts facilitate easy comparison and decision-making.

- Entrées personnalisables : Input the price data for the assets for the past 60 months and the allocations that you want to consider. The allocation calculations and charts will automatically update, allowing you to tailor the analysis to your specific investment goals and market conditions.

Avantages

- Convivial: Conçu avec des instructions claires et des formules intégrées pour rendre la modélisation financière à la fois efficace et simple.

- Reportage professionnel : Produisez des rapports financiers soignés pour impressionner les investisseurs, les prêteurs et les partenaires commerciaux.

À qui s'adresse ce modèle ?

- Investors and Portfolio Managers: Optimize your portfolio allocation to achieve the best balance between risk and return. This template is essential for making informed investment decisions.

- Financial Advisors and Consultants: Provide clients with expert portfolio analysis and customized investment strategies. This tool helps you deliver high-quality advisory services.

- Academic Researchers and Students: Utilize the template to study and understand portfolio optimization techniques, including the practical application of the Minimum Variance Portfolio and Sharpe ratio maximization.

Bien plus encore

Qu'est-ce qui est inclus ?

États financiers pro forma

Données fondamentales historiques

Assistance par e-mail gratuite

Analyse des ratios financiers

Graphiques et tableaux de bord

Évaluation d'entreprise

Projection des revenus et des coûts sur 5 ans

Regardez le tutoriel

Produits connexes

Révisé par des experts d'organisations de premier plan